|

Retire Early

Lifestyle

Retirement; like your parents, but way cooler

|

In 1991 Billy and Akaisha Kaderli retired at the age

of 38. Now, into their 4th decade of this

financially independent lifestyle, they invite you

to take advantage of their wisdom and experience. |

|

How to

Become a Millionaire

by 50 years of Age

Billy and Akaisha Kaderli

Becoming a millionaire by 50 years of age

seems like an ambitious goal these days. But is it really?

The secret is to start early.

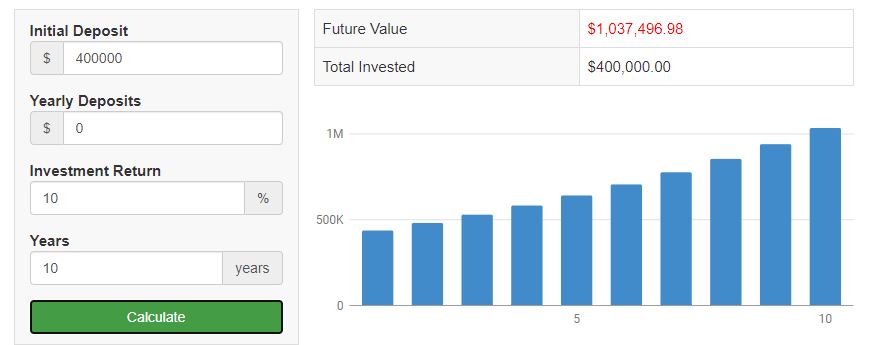

Let's take a look at some charts.

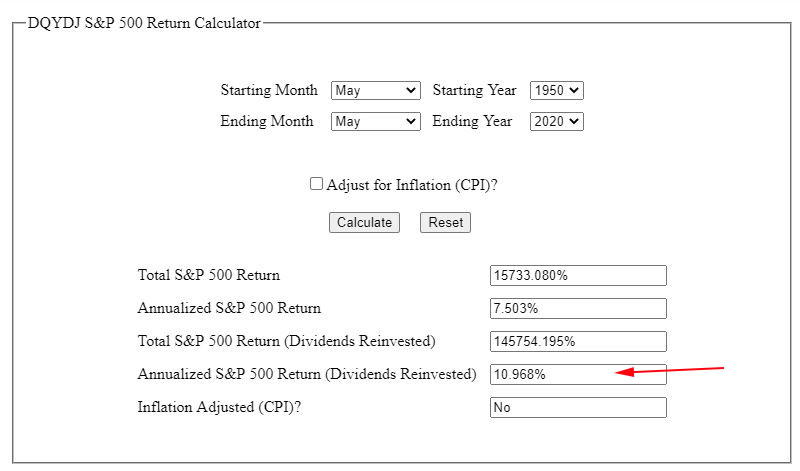

Using 70 years of data you can see that

the S&P 500 Index with dividends reinvested has returned over 10% annually.

For this financial

exercise I will set you at a 10% annual return, the same as the S&P 500

Index or the ETF symbol SPY. The first chart is out

of your control at this point but not for your kids.

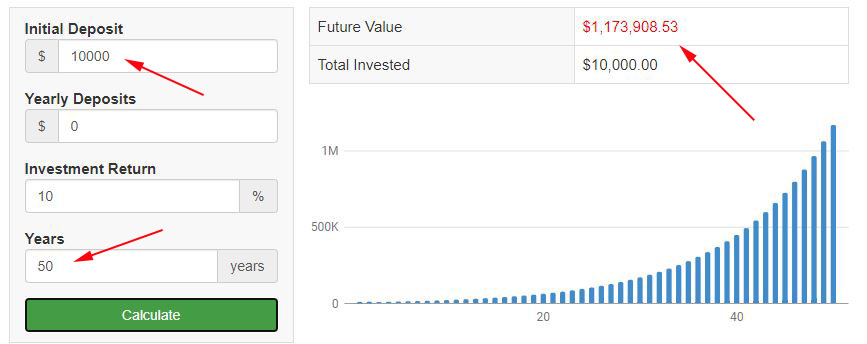

A $10,000 investment into the S&P 500

Index when your baby is born could be worth more than one million dollars by

the time they are fifty. This will create a solid foundation for their

financial future - and that is without adding another cent to their

investment. But

what if you wait until they are ten years old to start this plan and still

make it to one million dollars by the time they are fifty?

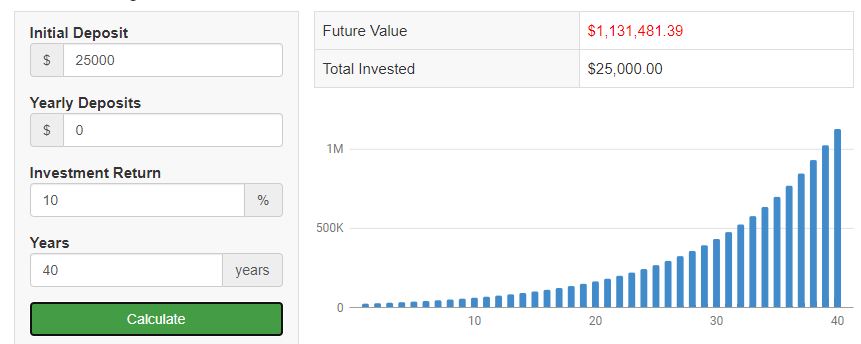

With a forty year investment opportunity

the initial investment now needs to be $25,000. This is two-and-a-half times more

than the amount needed if you began your deposit at birth.

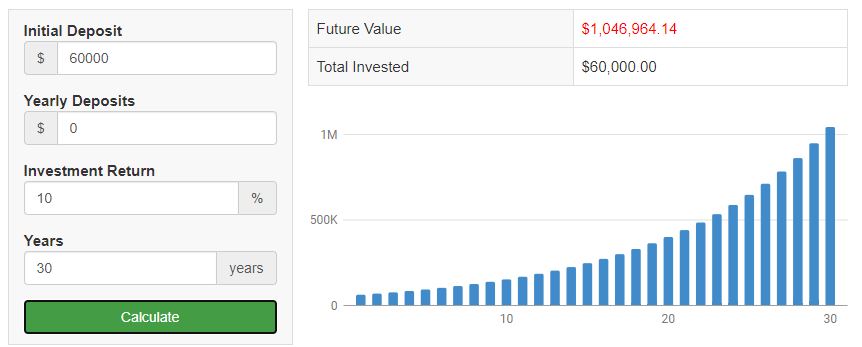

How about a 20 year old? How much do they

need to create this scenario?

Remember the goal is to become a

millionaire by the time they are fifty years old. They need $60,000

deposited to accomplish this goal.

Continuing this

exercise let's look at a 30 year old. How much do they need to deposit?

With only 20 years left before turning 50

years old, they need to deposit $150,000 and let the market work for them.

A forty year old is

getting down to crunch time and is going to have to make an even bigger

investment.

A deposit of $400K is what it will take to

create this plan of becoming a millionaire by the time they are 50 years

old.

As you can see,

time is on

your side when it comes to investing. The

earlier you get started the

less investment you will need to make.

Remember, all of these investments were a

one time investment. No other contributions were made other than dividends

being re-invested.

Now that you know this, you have the

tools to change your financial life or the life of your child or

grandchildren.

Get started today!

For more on

Retirement Topics,

click here and

here and don't forget to signup for

our free Newsletter.

About the Authors

Retire

Early Lifestyle appeals to a different

kind of person – the person who prizes their

independence, values their time, and who doesn’t

want to mindlessly follow the crowd.

HOME

Book Store

Retire Early Lifestyle Blog

About Billy & Akaisha

Kaderli

Press

Contact

20 Questions

Preferred

Links

Retirement

Country Info

Retiree

Interviews

Commentary

REL

Videos

|